2. System Architecture

2. System Architecture and Process Flow

2.1 System Architecture

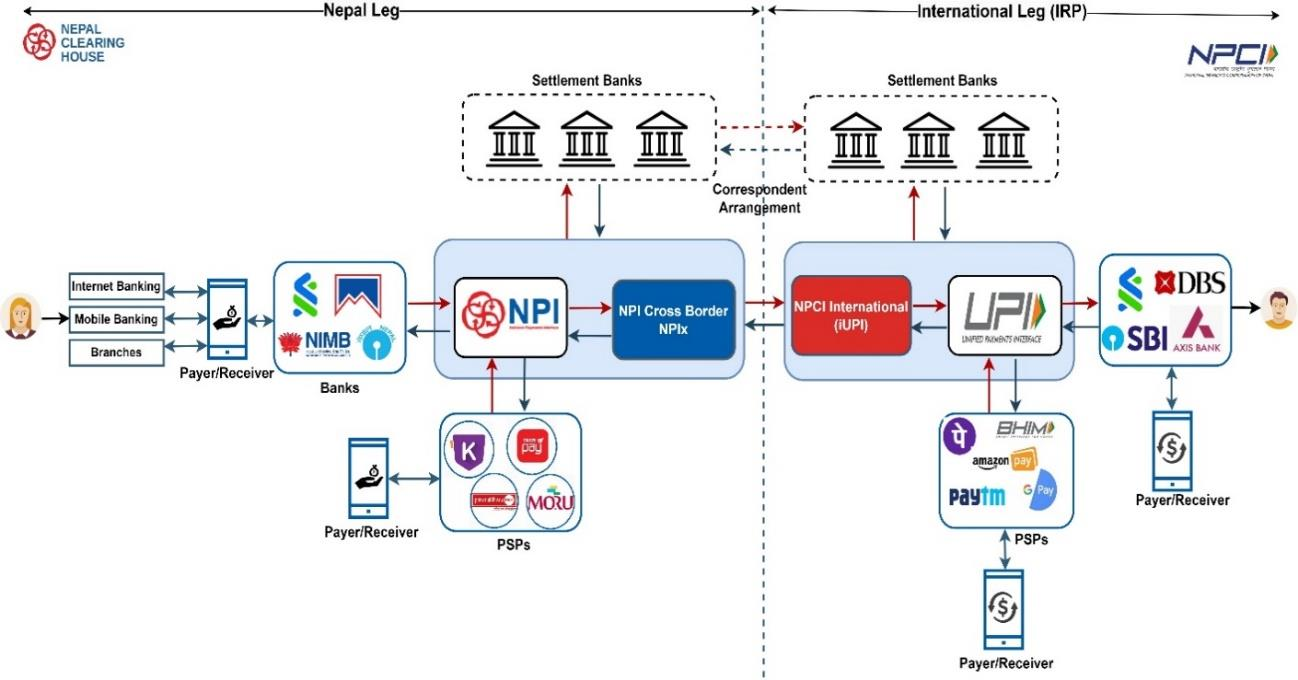

The integration of NCHL’s National Payments Interface (NPI) and NPCI’s Unified Payment Interface (UPI) will enable both xBorder Inward and Outward fund transfers initiated from the respective channels like mobile banking, issuing app, internet banking or bank branches. The xBorder fund transfer transaction will involve domestic leg in Nepal and international leg in the foreign jurisdiction. NPIx that is an extension of the existing National Payment Interface (NPI) will be responsible for all kinds of international communications with iUPI of UPI of India. All domestic processes of xBorder transfer including interconnection with the participants will be handled by NPI itself.

Fig: An example image for demonstration purposes.

2.2 xBorder Inward Transfer

The xBorder inward transfer deals with the inward fund transfer to Payee (Receiver) in Nepal through a Payer (Sender) in India.

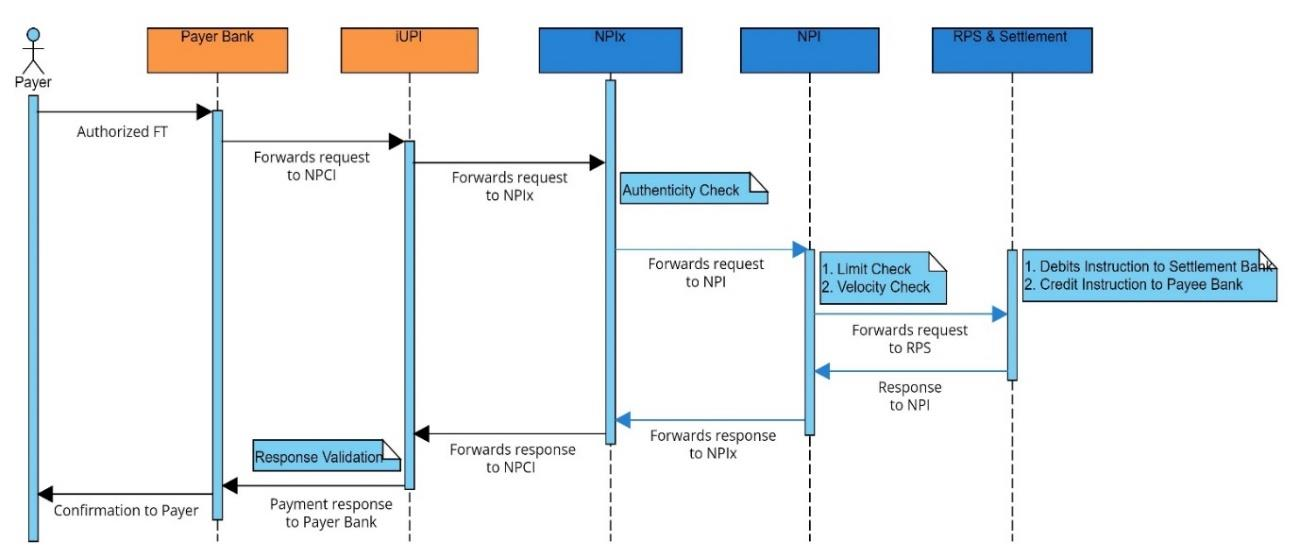

2.2.1 Inward Non-Financial Flow

In non-financial leg, activities related to compliance screening, customer validation and limit checks are performed to ensure the authenticity & validity of the transactions being performed.

Fig: Sequence Diagram: Inward Non-Financial Leg.

Steps- Payer initiates a fund transfer using UPI enabled applications of their Payer Bank.

- Payer Bank transmits the payment request to UPI system.

- NPCI’s iUPI routes the request to NPIx for the purpose of screening and validation.

- NPIx verifies the request's authenticity and transfers it to NPI for further processing.

- Beneficiary bank conducts essential account validation and confirms consent.

- The bank also performs the necessary AML and CFT checks. For the case of Nepal-India, the compliance screening bank and beneficiary bank will be the same.

- The validation response is then sent by the beneficiary bank to NPI.

2.2.2 Inward Financial Flow

Financial Flow starts after successful validation of payer and payee details in the non-financial leg.

Fig: Sequence Diagram: Inward Financial Leg.

Steps- Once the payer's account is successfully validated by iUPI, it will authorize the fund transfer.

- Payer Bank sends a transfer request to UPI to initiate an international transfer process.

- NPCI’s iUPI routes the request to NPIx for a fund transfer.

- NPIx verifies the request's authenticity and then passes to NPI for further processing.

- After validation for transfer limits and others, NPI routes the request to RPS switch.

- NPI commences the credit transaction in the beneficiary.

- After the credit at beneficiary is completed, NPI send a response to NPIx.

- NPIx gathers the necessary details to create a payment response for iUPI of NPCI.

- iUPI, after necessary validation, relays the response to its payer's bank.

- The payer's bank delivers the final payment confirmation to the payer.

2.3 xBorder outward transfer

The xBorder outward transfer deals with the outward fund transfer from a Payer (Sender) in Nepal to Payee (Receiver) in India.

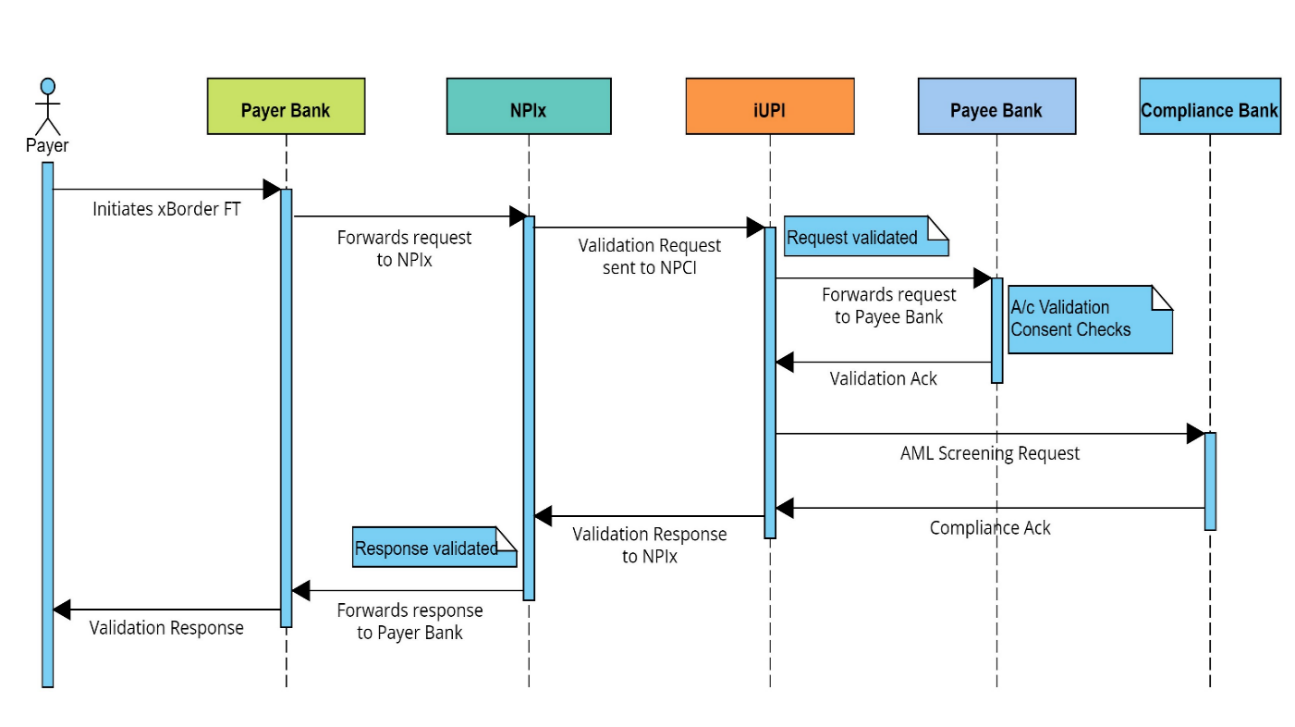

2.3.1 Outward Non-Financial Leg

The Non-Financial leg involves activities such as customer validation, compliance screening, and limit checks are performed to ensure the authenticity of the transactions being performed, as presented in the sequence diagram below.

Fig: Sequence Diagram: Outward Non-Financial Leg.

Steps- Fund transfer process is initiated by a customer (Payer) by using any of the issuing instruments provided by its bank.

- Payer bank transfers the customer's request to NPIx, which subsequently sends a validation request to iUPI.

- iUPI validates the request message and the it forwards the transfer message to its payee bank for necessary AML and CFT checks as per its arrangement.

- Following successful validation of the Payee account, iUPI sends a response back to NPIx for initiating a financial leg.

- NPIx then routes the response to payer's bank, which in turn communicates the validated response to the Payer.

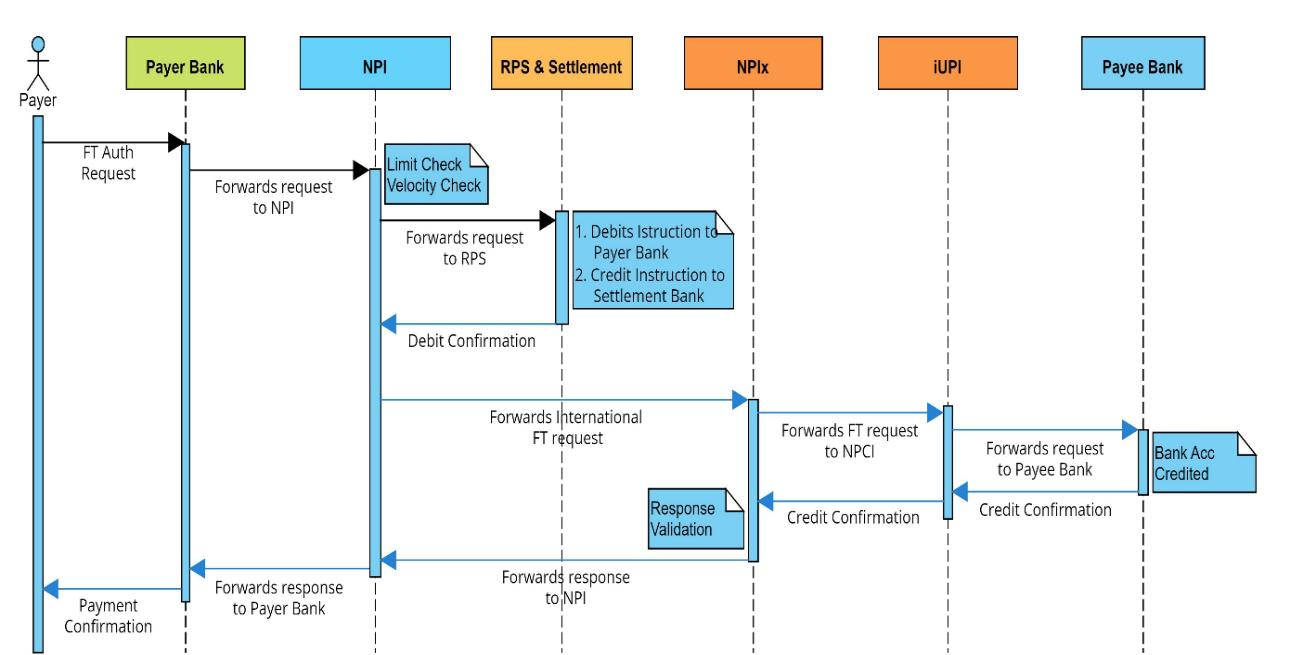

2.3.2 Outward Financial Leg

Financial leg starts after successful validation of payer and payee details in the non-financial leg.

Fig: Sequence Diagram: Outward Financial Leg.

Steps- After the non-financial validating of the customer, the payer authorizes the fund transfer.

- Payer Bank routes the request to NPI to commence a xBorder transfer process.

- NPIx conducts the limit and other checks before routing the request to RPS switch.

- RPS switch initiates a debit instruction to payer's bank & credit instructions to settlement bank.

- Following successful debit and credit transaction in Nepal leg, an international fund transfer request is sent to the Payee Bank through NPIx to iUPI.

- Payee bank's account is credited once the fund transfer request is successfully validated at UPI end. A credit confirmation is then relayed from the Payee Bank to NPIx through iUPI.

- NPIx forwards the confirmation response to the Payer Bank via NPI.

- The Payer Bank provides payment confirmation to the payer, completing the process.

2.4 xBorder Settlement Process

2.4.1 xBorder Settlement and Correspondent Arrangement

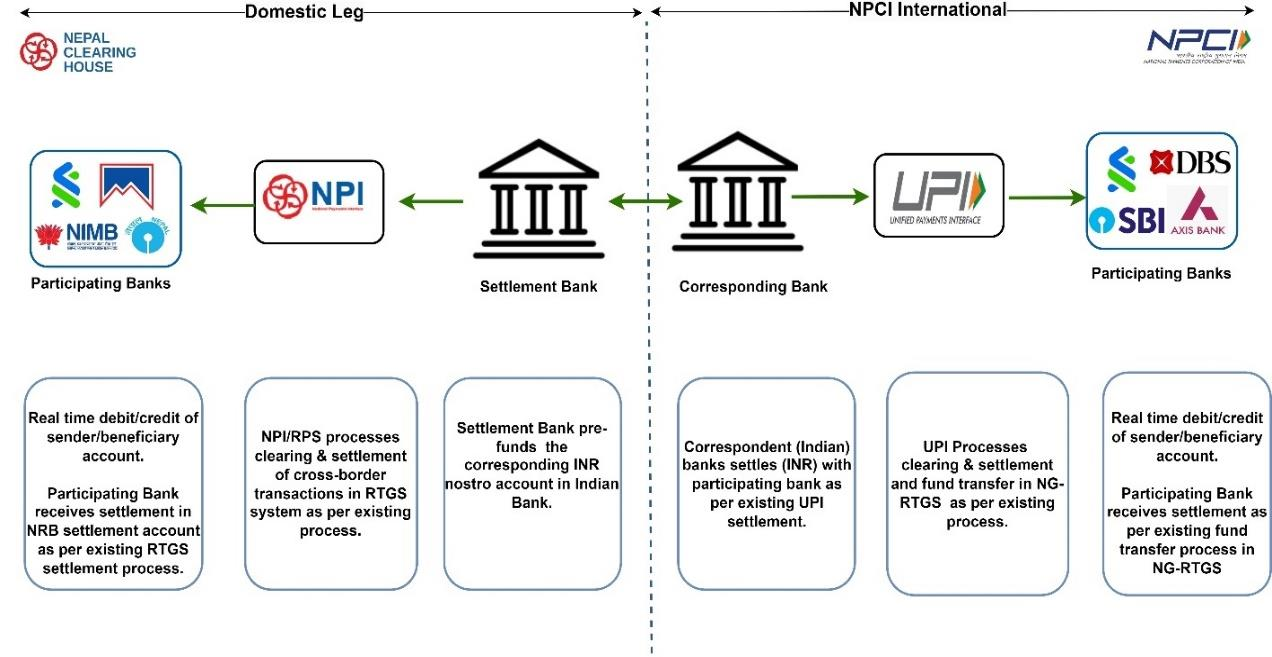

The xBorder transactions settlement will be done through a correspondent arrangement between settlement bank(s) in Nepal and its corresponding bank in India. The settlement bank in Nepal is required to pre-fund its Nostro account at the corresponding Indian bank in INR currency before initiating any xBorder transactions. The pre-funding mechanism will be as per the existing correspondent arrangement between settlement bank in Nepal and its corresponding bank in India. A necessary authorization will be provided by such settlement bank in Nepal to make necessary entries in its internal account against its Vostro account. Technical arrangement will be capable to handle multiple settlement banks in Nepal, corresponding to which the implementation of multiple correspondent banks will be based on mutually discussion/ engagement with NPCI.

2.4.2 xBorder Transactions Settlement

The domestic settlement for xBorder transactions between participating BFIs and settlement bank will be managed by the respective networks on both Nepal and Indian sides. NCHL will handle the domestic settlement of participants BFIs using RTGS system, corresponding to which individual transactions will be processed through RPS, which is backed by settlement guarantee fund.

2.4.3 xBorder Settlement Process Flow

Fig: xBorder Settlement Process.